Midwest Company is launching its IPO on October 15, 2025, and it will close on October 17, 2025. – The Midwest IPO is a combination of a fresh issue of 0.23 crore shares (total ₹250.00 crore) and an offer-for-sale of 0.19 crore shares (total ₹201.00 crore) with a price band of ₹1014 to ₹1065 per share. The company aims to raise ₹451.00 crore from investors through the stock markets. According to the upper band price, the estimated market valuation of the issue is approximately ₹4,200 crore.

Midwest Limited is a leading granite producer based in Telangana/Andhra Pradesh. The company operates in the dimensional stone/natural stone (granite) sector and serves international clients in over 30 countries through mining, processing, and export activities. It supplies products to solar glass manufacturers and building materials companies – sectors that are becoming increasingly popular due to the global shift towards renewable energy and sustainable materials.

In this detailed article, we will deep dive into the Midwest IPO details, company overview, numbers, charts, valuation, and risks related to the IPO.

Midwest IPO: Important Dates and Timelines

The price band of the Midwest IPO has been fixed at ₹1014 to ₹1065 per share. The lot size for the application is 14. Hence, the minimum investment amount required for a retail investor is ₹14,910 (14 shares) (based on the upper price). The lot size investment for SNII is 14 lots (196 shares), amounting to ₹2,08,740, and for BNII, it is 68 lots (952 shares), amounting to ₹10,13,880.

Let’s look at some important details related to the Midwest IPO :

| Parameters | Details |

| IPO Open Date | 15 October 2025 |

| IPO Close Date | 17 October 2025 |

| Issue Price range | ₹ 1,014 to ₹ 1,065 per equity share |

| Face Value | ₹ 5 per share |

| Lot Size | 14 shares per lot |

| Total Issue Size | ₹ 451 Crore (Both OFS and Fresh Issue) |

| Offer For Sale | ₹ 201 Cr ( 0.19 crore Shares) |

| Total Fresh Issue | ₹ 250 Cr ( 0.23 Crore Shares) |

| Registrar | Kfin Technologies Ltd. |

| Employee Discount | ₹ 101.00 |

| Listing At | NSE Or BSE |

Midwest IPO Important Timelines:

The Midwest IPO is open for subscription from October 15, 2025, and will close on October 17, 2025. The allotment for the Midwest IPO is expected to be finalized on October 20, 2025. The IPO is going to be listed on both the BSE and NSE exchanges, with a tentative listing date of October 24, 2025.

| IPO Open Date | Wed, 15 October 2025 |

| IPO Close Date | Fri, 17 October 2025 |

| Allotment Date | Mon, 20 October 2025 |

| Initiation of Refund | Thu, 23 October 2025 |

| Shares Credit to Demat | Thu, 23 October 2025 |

| Listing Date in Exchange | Fri, 24 October 2025 |

Midwest IPO Lot Sizes:

Midwest is raising ₹451 crore from investors through financial markets. Retail investors can bid for a minimum of 14 shares (1 lot) in this IPO. Like every IPO, Midwest’s IPO also has minimum and maximum investment limits for individual investors (retail) and high net worth investors (HNIs) in terms of shares and amount. Let us take a look at the prescribed amounts for different investor slabs.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 14 | ₹ 14,910 |

| Retail (Max) | 13 | 182 | ₹ 1,93,830 |

| S-HNI (Min) | 14 | 196 | ₹ 2,08,740 |

| S-HNI (Max) | 67 | 938 | ₹ 9,98,970 |

| B-HNI (Min) | 68 | 952 | ₹ 10,13,880 |

Investor category and their reservation:

Qualified Institutional Buyers (QIBs): 50% ( 21 lakhs shares reserved) Non-Institutional Investors (NIIs/HNIs): 15% (06 lakhs shares reserved) Retail Individual Investors (RIIs): 35% (14 lakhs shares reserved)

If you want to learn about cryptocurrency, you can learn from here

What is Midwest? (Company Overview)

Midwest Company was founded in 1981. It is headquartered in Hyderabad, Telangana, India. The company is in the business of natural stone mining and processing and serves its international clients in more than 30 countries through export activities.

Black Galaxy Granite is Midwest Limited’s flagship product, forming the core of its mining and processing operations. The company is a leader in the export of Black Galaxy granite from India, making it a major contributor to the Midwest’s revenue. This expertise makes Midwest a leader in the premium natural stone market globally. The Company produces about 15.7% of India’s Absolute Black Granite production. In FY25 Midwest exported 44,992 cubic meters of Black Galaxy Granite.

Some Key Features of the Midwest

The company Midwest has 16 granite mines operating in Telangana and Andhra Pradesh. These quarries primarily mine the company’s flagship product, Black Galaxy Granite, and adhere to stringent quality standards.

It has two granite processing units at Chimakurthi and Ongole, where raw granite blocks are cut, polished, and finished.

Midwest has a dedicated facility in Hyderabad that produces diamond wire tools used for granite cutting and mining. This manufacturing facility also supports innovation and efficiency improvements in granite extraction processes.

The company has a quartz processing plant at Annangi village in Andhra Pradesh with an initial capacity of 3,03,600 metric tonnes per annum (MTPA), and plans to double the capacity in the second phase, which will drive future growth and increase revenue potential.

Midwest IPO Financial Overview:

Here is the company’s financial information for the last three years:

ALL values in crores –

| Periods Ended | FY25 | FY24 | FY23 |

| Total Revenue | 626 | 586 | 503 |

| Profit After Tax | 133 | 100 | 54 |

| Net Worth | 553 | 499 | 411 |

| Total Assets | 1,082 | 757 | 656 |

| Reserve and Surplus | 602.26 | 404.86 | 408.88 |

| EBITDA Margin | 27.43% | 28.87% | 21.77% |

| PAT Margin | 17.17% | 17.13% | 10.83% |

| Debt / Borrowings | 236.61 | 120.48 | 149.08 |

| Return on Equity (RoE) | 19.43% | 20.10% | 13.22% |

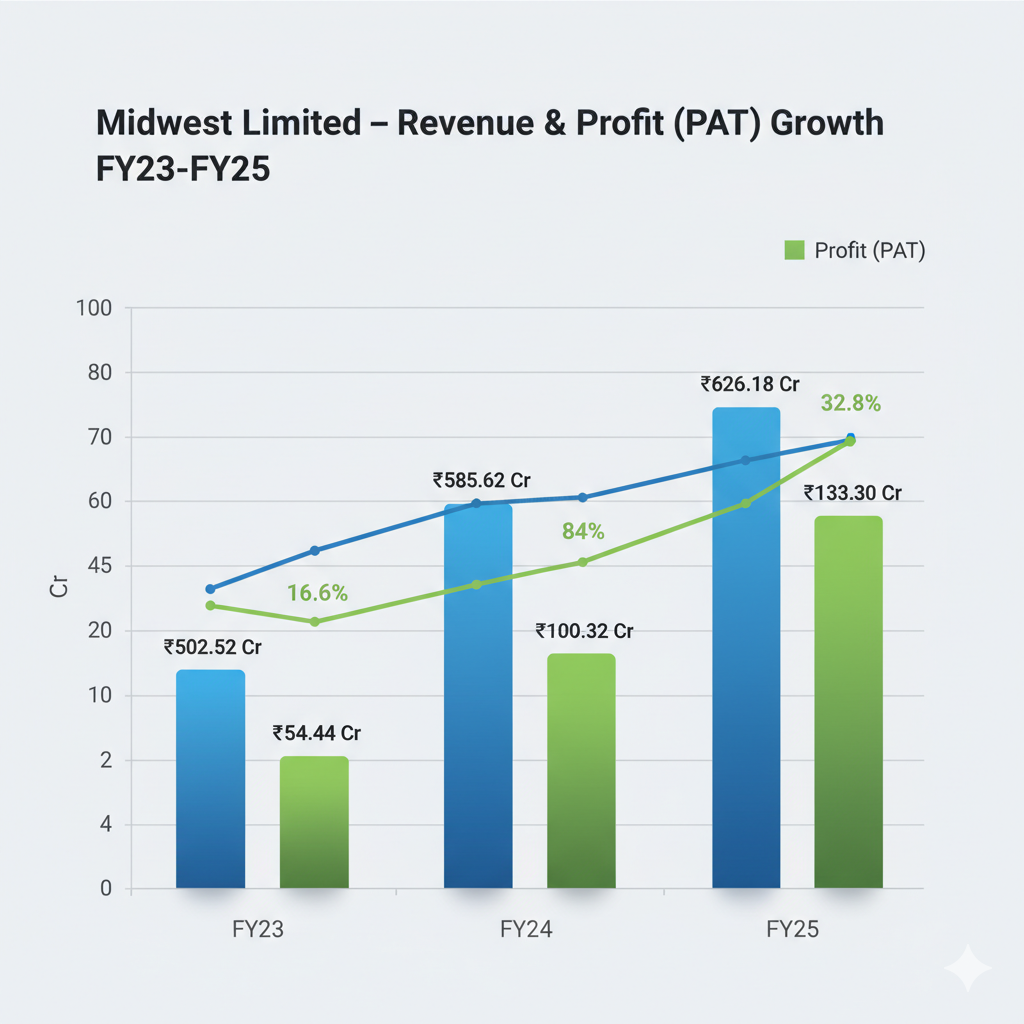

Midwest Limited recorded revenue of ₹502.52 crore in FY23, which increased to ₹585.62 crore in FY24, a growth of 16.6%. In FY25, revenue increased to ₹626.18 crore, representing a growth of 6.9% over FY24. Midwest’s operating revenue has grown 24% over two fiscal years.

Midwest Company reported a profit after tax (PAT) of ₹54.44 crore in FY23, which increased to ₹100.32 crore in FY24 – an impressive 84% growth due to improved operational efficiency and cost management. In FY25, PAT increased to ₹133.30 crore, representing a growth of 32.8% over FY24, reflecting sustained profitability and shareholder value creation. Midwest’s PAT grew 145% in two financial years.

Risks Involved in Midwest IPO

Operational Risk: Mining and processing operations involve risks such as equipment failure, labor shortages, and supply chain disruptions. Any operational inefficiency can increase costs or delay production. These risks can directly impact revenue and profit margins.

Dependence on Black Galaxy Granite: A large portion of the Midwest’s revenue comes from the export of Black Galaxy Granite. A decline in global demand or the emergence of new competitors could impact revenue. Dependence on a single product puts the company at risk of market concentration.

Regulatory Risk: Changes in mining laws, environmental regulations, or export-import policies may impact business operations. Compliance with stricter norms could increase operational costs. Non-compliance may also result in legal penalties or disruptions in production.

The Conclusion

Midwest IPO presents an attractive investment opportunity in the natural stone and granite industry, driven by its strong market position and consistent financial performance over the past financial years. The company comes with a major presence in Black Galaxy granite exports, technologically advanced processing units, and strategic expansion plans like the Phase II Quartz plant. The Midwest is well-positioned for long-term growth.

You can invest in a Midwest IPO, but do so at your own risk, after thoroughly researching the company, analyzing its financial reports, and its business model. Short-term investors may see modest gains from the listing, while long-term investors may benefit from the company’s continued growth in financial services.

What is the price band of the Midwest IPO?

The Midwest IPO price band is ₹1,014 to ₹1,065 per share.

What is the lot size and minimum investment?

Each lot contains 14 shares, making the minimum investment ₹14,910 at the upper price band.

When does the Midwest IPO open and close?

The Midwest IPO Opens For subscription period from October 15, 2025, and it will close on October 17, 2025.

what is the total issue size of the Midwest IPO?

The total IPO size is ₹451 crore, including ₹250 crore as a fresh issue and ₹201 crore via Offer for Sale (OFS) by promoters

When will Midwest Company shares be allotted to investors?

The Share of Midwest Company allotted to investors on Mon, 20 October 2025.

On which stock exchanges will the Midwest IPO be listed?

The Midwest IPO is going to list on both the NSE AND BSE exchanges.

I am so happy to read this. This is the type of manual that needs to be given and not the random misinformation that’s at the other blogs. Appreciate your sharing this best doc.