In the rapidly evolving Indian fintech sector, one of the most anticipated initial public offerings (IPOs) of 2025 is Groww’s IPO.

Groww is now making its debut on the public market under its parent company, Billionbrains Garage Ventures Ltd. The IPO will open for subscription on November 4, 2025, and close on November 7, 2025.

The Groww IPO comprises a fresh issue of 10.6 crore shares (totaling ₹1,060 crore) and an offer-for-sale of 55.7 crore shares (totaling ₹5,572 crore), with a price band of ₹95 to ₹100 per share. The company aims to raise ₹6,632 crore from investors through the financial markets.

At the upper end of the price band, the estimated market valuation of the issue is approximately ₹61,736 crore.

Groww was founded in 2016 by a team of four former Flipkart employees – Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh.

The journey began with a simple idea: to make investing in the stock market easy and accessible for Indians. Over time, Groww expanded to include equities, mutual funds, ETFs, IPO access, derivatives, digital gold, and much more.

By the end of June 2025, the platform had become one of India’s largest retail investing platforms, with 12.6 million active clients on the NSE.

Groww IPO: Important Dates and Timelines

The price band for the Groww IPO has been fixed at ₹95 to ₹100 per share. The lot size for the application is 150 shares per lot. Therefore, the minimum investment amount required for a retail investor is ₹15,000 (150 shares) (based on the upper price band). The lot size investment for SNII is 14 lots (2,100 shares), costing ₹2,10,000, and for BNII it is 67 lots (10,050 shares), costing ₹10,05,000.

Let’s look at some important details related to the Groww IPO:

| Parameters | Details |

| IPO Open Date | 04 November 2025 |

| IPO Close Date | 07 November 2025 |

| Issue Price range | ₹ 95 to ₹ 100 per equity share |

| Face Value | ₹ 2 per share |

| Lot Size | 150 shares per lot |

| Total Issue Size | ₹ 6632.3 Crore (Both OFS and Fresh Issue) |

| Offer For Sale | ₹ 1,060.00 Cr ( 10.6 crore Shares) |

| Total Fresh Issue | ₹ 5572.30 Cr (55.70 Crore Shares) |

| Registrar | MUFG Intime India Pvt Ltd. |

| Lead Manager | Kotak Mahindra Capital Pvt Ltd. |

| Employee Discount | NA |

| Listing At | NSE Or BSE |

Groww IPO Important Timelines:

The Groww IPO is open for subscription from November 04th, 2025, and will close on November 07th, 2025. The allotment for the Groww IPO is expected to be finalized on November 10, 2025. The IPO is going to be listed on both the BSE and NSE exchanges, with a tentative listing date of November 12, 2025.

| IPO Open Date | Tue, 04 November 2025 |

| IPO Close Date | Fri, 07 November 2025 |

| Allotment Date | Mon, 10 November 2025 |

| Initiation of Refund | Tue, 11 November 2025 |

| Shares Credit to Demat | Tue, 11 November 2025 |

| Listing Date in Exchange | Wed, 12 November 2025 |

Groww IPO Lot Sizes:

The company Groww (Billionbrains Garage Ventures Ltd) is raising ₹6632 crore from investors through financial markets. Retail investors can bid for a minimum of 150 shares (1 lot) in this IPO.

Like every IPO, the Groww IPO also has minimum and maximum investment limits for individual investors (retail) and high net worth investors (HNIs) in terms of shares and amount. Let us take a look at the prescribed amounts for different investor slabs.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 150 | ₹ 15,000 |

| Retail (Max) | 13 | 1,950 | ₹ 1,95,000 |

| S-HNI (Min) | 14 | 2,100 | ₹ 2,10,000 |

| S-HNI(Max) | 66 | 9,900 | ₹ 9,90,000 |

| B-HNI (Min) | 67 | 10,050 | ₹ 10,05,000 |

Investor Category and their reservation:

| Investor Category | Reservation |

| Qualified Institutional Buyers (QIBs): | 75% ( 49.7 Crore shares ) |

| Non-Institutional Investors (NIIs/HNIs): | 15% ( 9.9 Crore shares ) |

| Retail Individual Investors (RIIs): | 10% ( 6.6 Crore shares ) |

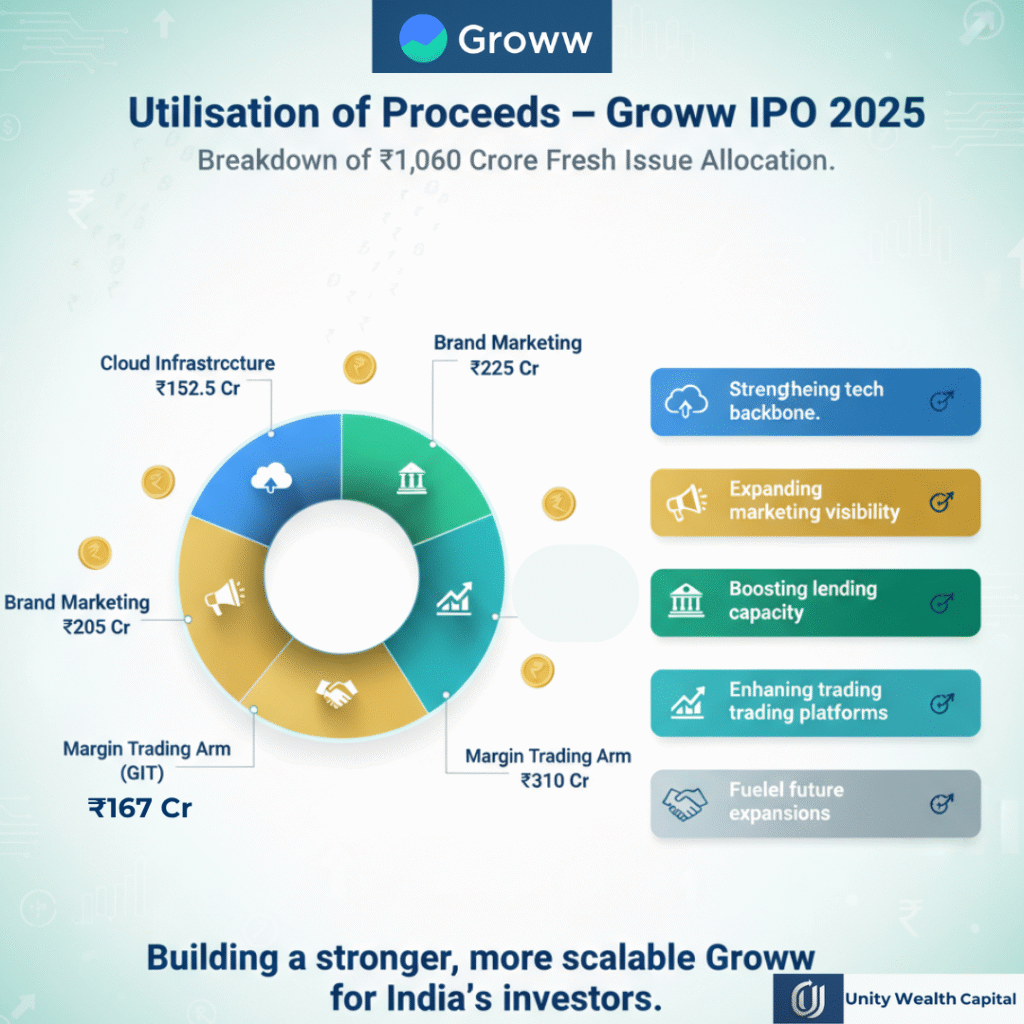

Utilisation of Proceeds

| Purpose | Values in Cr |

| Investments in cloud infrastructure | ₹152.5 (14.38%) |

| Investments in Brand-building and performance marketing activities | ₹225 (21.22%) |

| Investment in material subsidiary (NBFC arm: Groww Creditserv Technology Pvt Ltd, “GCS” | ₹205 (19.33%) |

| Investment in material subsidiary (margin-trading arm: Groww Invest Tech Pvt Ltd, “GIT”) for funding MTF | ₹167.5 (15.80%) |

| Remaining for inorganic growth (acquisitions) and general corporate purposes | ₹310 (2 |

What is Groww? (Company Overview)

Groww is engaged in the wealth management and broking business. Groww is a leading online investment and wealth management platform in India that has completely transformed the way millions of Indians invest their money in the financial markets.

Groww provides an investment platform that allows users to easily invest in stocks, mutual funds, ETFs, IPOs, bonds, and much more – all through a single mobile app and its website.

Some Key Features of the Lenskart

Groww was founded in 2016 by four former Flipkart employees – Lalit Keshre, Harsh Jain, Ishan Bansal, and Neeraj Singh. Groww started with a simple mission: to make investing accessible, transparent, and easy for everyone. This mission is now being realized, helping millions of investors and finance enthusiasts.

It created an easy-to-use mobile app with a clean design, jargon-free language, and a simple user experience. The entire onboarding process could be completed in just a few minutes. This focus on user ease and trust became Groww’s biggest competitive advantage.

With over 12 million active clients by 2025, Groww has surpassed larger competitors like Zerodha and Angel One in terms of retail participation.

The platform’s key strengths lie in its clean design, easy KYC process, and fast trade execution.

Groww is backed by major global investors such as Tiger Global, Sequoia Capital, Y Combinator, and Ribbit Capital. With their support, Groww has built strong brand credibility in a short span of time. Now, these existing major investors are partially exiting through the OFS (Offer for Sale) route and realizing their returns through the Groww IPO.

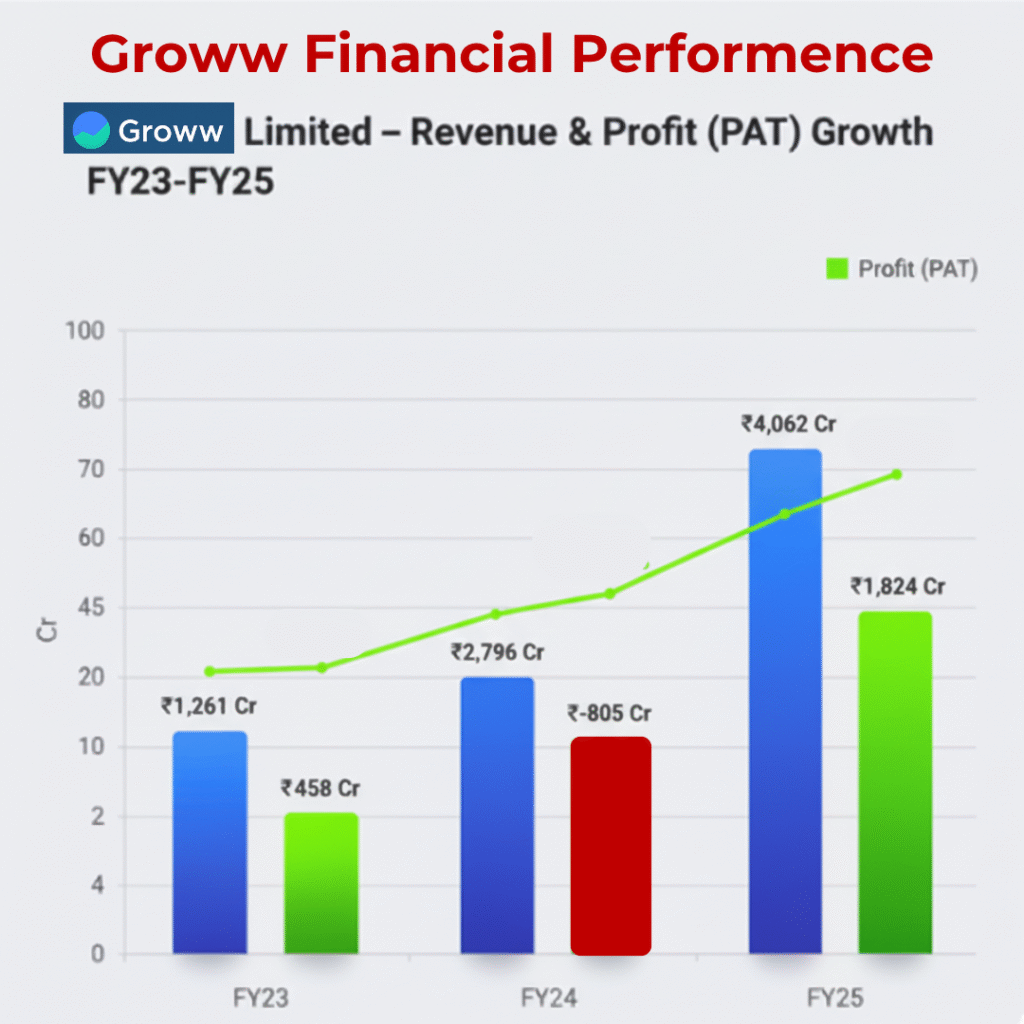

Groww Financial Overview

Here is the company’s financial information for the last three years:

| Periods Ended ( Values in Cr) | FY23 | FY24 | FY25 |

| Total Revenue | 1,262 | 2,796 | 4,062 |

| Profit After Tax | 458 | -805 | 1,824 |

| Net Worth | 3,316.75 | 2,542.64 | 4,855 |

| Total Assets | 4,808 | 8,018 | 10,077 |

| Reserve and Surplus | 4,445.6 | 2,477.8 | 3,252 |

| PAT Margin | 40.08% | -30.87% | 46.76% |

| Debt / Borrowings | —- | 24 | 352 |

| Return on Equity (RoE) | 13.8% | -31.68% | 37.57% |

Groww Limited recorded revenue of ₹1,261 crore in FY23, which increased to ₹2,796 crore in FY24, representing a growth of 122%. In FY25, revenue increased to ₹4,062 crore, representing a 45% growth over FY24. Groww’s operating revenue has grown by 222% in two financial years.

Groww reported a profit of ₹458 crore in FY23, which reduced to a ₹ 805 crore loss in FY24. In FY25, the company reported a Profit After Tax (PAT) of ₹1,824 crore, a significant increase compared to FY24.

Strengths of Groww:

Groww has built a solid reputation as one of the most trusted and transparent investment platforms across cities, towns, and villages in India.

As of June 2025, Groww has over 12.58 million active clients, making it India’s largest retail brokerage platform by active users — surpassing even Zerodha and Angel One. This wide base gives Groww a strong network effect and recurring revenue.

The company’s brand recall is demonstrated by the new organic customers. Groww had a 25% market share in new net demat account additions from June 2024 to June 2025.

Groww revenue from operations grew at a CAGR of 84.88% from fiscal 2024 to Fiscal year 2025.

Groww turned profitable again in FY 2025 with ₹ 1,824 crore PAT and a 47% PAT margin — showing that its growth is not just in users but also in revenue quality and sustainability.

Risks Involved in Groww IPO

The Indian brokerage and investment industry is highly competitive, with major players like Zerodha, Angel One, Upstox, and traditional banks constantly improving their digital platforms. Any price war, innovation race, or customer migration to another company could negatively impact Groww’s market share and profits.

Changing laws, rules, and regulations may adversely affect the business, prospects, and results of operation.

Business is subject to evolving regulations. SEBI`s October 2024 derivatives framework impacted transaction volumes, leading to a reduction in active broking users from 7.24million in Q1 FY25 to 6.12 million in Q1 FY2026.

As a fully digital platform, Groww is exposed to risks like hacking, data breaches, or system failures. A single cybersecurity incident could damage customer trust and attract regulatory penalties.

If you want to learn about cryptocurrency, learn from here: What is cryptocurrency?

The Conclusion

Groww started with a simple vision: to make investing easy and transparent for everyone. Groww has quickly become one of India’s most trusted and fastest-growing online investment platforms, making investing accessible to millions of new investors.

Groww has demonstrated exceptional financial performance over the past few years, with consistent revenue growth, strong user acquisition, improved customer retention, and expanding profit margins.

You can invest in the Groww IPO, but do so at your own risk, only after thoroughly researching the company, analyzing its financial reports, and understanding its business model. Short-term investors may see some gains from the listing, while long-term investors could benefit from the company’s continued growth in the financial services sector.

Frequently Asked Questions

What is the price band of the Groww IPO?

The Groww IPO price band is ₹ 95 to ₹ 100 per share.

What is the lot size and minimum investment?

Each lot contains 150 shares, making the minimum investment ₹15,000 at the upper price band.

When does the Groww IPO open and close?

The Groww IPO Opens For subscription period from November 04, 2025, and it will close on November 07, 2025.

What is the total issue size of the Groww IPO?

The total IPO size is ₹ 6632 crore, including ₹ 1060 crore as a fresh issue and ₹5572 crore via Offer for Sale (OFS) by promoters.

When will Groww IPO shares be allotted to investors?

The Share of Groww Company allotted to investors on Mon 10, November 2025.

On which stock exchanges will the Groww IPO be listed?

The Groww IPO is going to list on both the NSE AND BSE exchanges.

Who is the registrar of the Groww IPO?

The registrar of the Groww IPO is MUFG Intime Pvt Ltd. You can check the Groww IPO allotment status on the website of the IPO registrar.