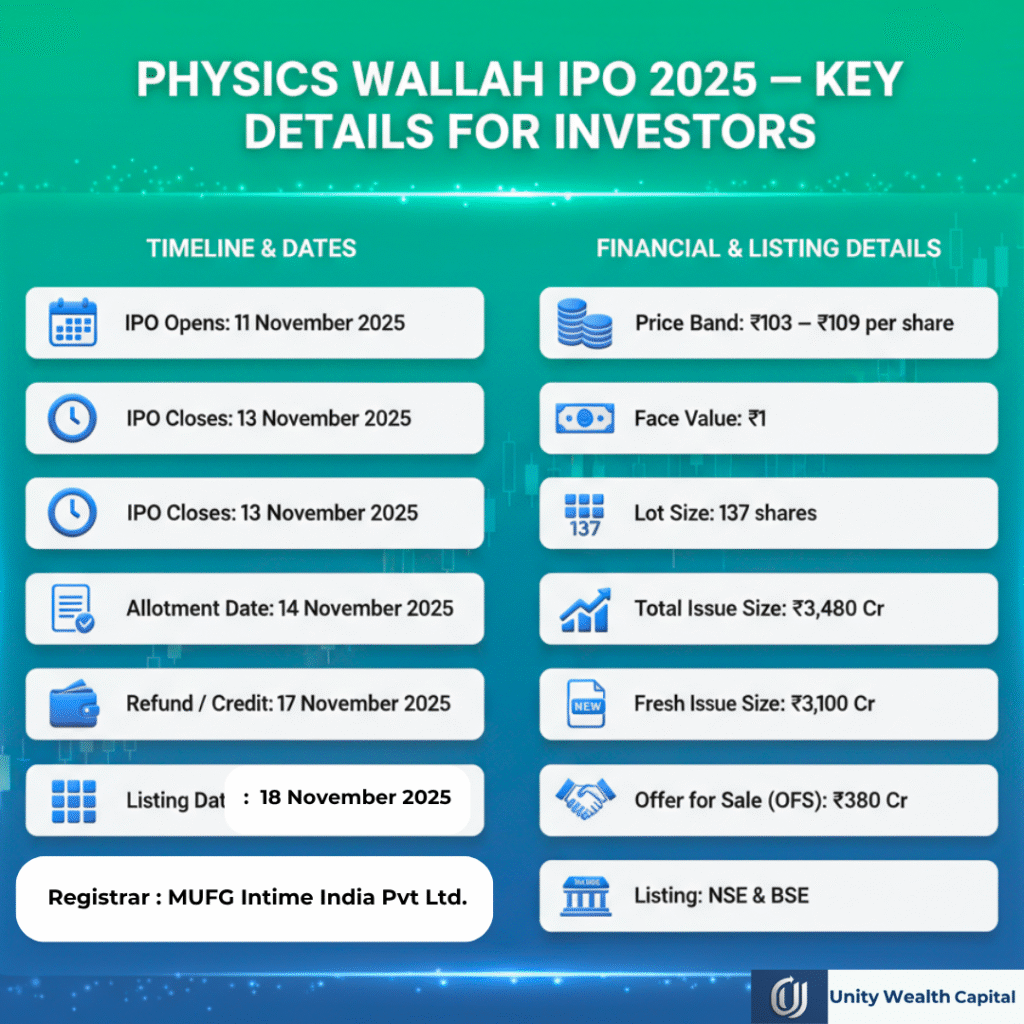

PhysicsWallah is launching its IPO on November 11, 2025, and it will close on November 13, 2025. – The PhysicsWallah IPO is a combination of a fresh issue of 28.44 crore shares (totalling ₹3100.00 crore) and an offer-for-sale of 3.49 crore shares (totalling ₹380 crore), with a price band of ₹103 to ₹109 per share. The company aims to raise ₹3480 crore from investors through the financial markets. At the upper end of the price band, the estimated market valuation of the issue is approximately US$3.19 billion (≈ ₹31,500 crore).

Physicswala is a technology-driven EdTech company that designs, develops and delivers educational content for competitive exams and school curriculum across India through online, offline and hybrid models.

PhysicsWallah was founded by Alakh Pandey and co-founder Prateek Maheshwari in 2016 as a YouTube channel. This channel provided physics tutoring for students preparing for competitive exams like JEE and NEET.

Over time, the company registered itself as an ed-tech business (in 2020), offering online live classes, recorded lectures, test series, study materials, and, more recently, offline/hybrid centres. PhysicsWallah also offers test preparation courses for various competitive exams like JEE, NEET, UPSC, etc., and upskilling courses in areas such as data science and analytics, banking and finance, software development, and more.

PhysicsWallah IPO: Important Dates and Timelines

The price band of the PhysicsWallah IPO has been fixed at ₹103 to ₹109 per share. The lot size for applications is 137 shares per lot. Therefore, the minimum investment amount required for a retail investor is ₹14,933 (137 shares) (based on the upper price band). The lot size investment for SNII is 14 lots (1918 shares), costing ₹2,09,062, and for BNII it is 67 lots (9,179shares), costing ₹10,00,511.

Let’s look at some important details related to the PhysicsWallah IPO :

| Parameters | Details |

| IPO Open Date | 11 November 2025 |

| IPO Close Date | 13 November 2025 |

| Issue Price range | ₹103 to ₹ 109 per equity share |

| Face Value | ₹ 1 per share |

| Lot Size | 137 shares per lot |

| Total Issue Size | ₹ 3480 Crore (Both OFS and Fresh Issue) |

| Offer For Sale | ₹ 380.00 Cr (3.49 crore Shares) |

| Total Fresh Issue | ₹ 3100 Cr (28.44 Crore Shares) |

| Registrar | MUFG Intime India Pvt Ltd. |

| Employee Discount | ₹ 10.00 |

| Listing At | NSE Or BSE |

PhysicsWallah IPO Important Timelines:

The PhysicsWallah IPO is open for subscription from 11th November 2025 and will close on 13th November 2025. The allotment for the PhysicsWallah IPO is expected to be finalised on November 14th, 2025. The IPO is going to be listed on both the BSE and NSE exchanges, with a tentative listing date of November 18th, 2025.

| IPO Open Date | Tue, 11 November 2025 |

| IPO Close Date | Thu, 13 November 2025 |

| Allotment Date | Fri, 14 November 2025 |

| Initiation of Refund | Mon, 17 November 2025 |

| Shares Credit to Demat | Mon, 17 November 2025 |

| Listing Date in Exchange | Tue, 18 November 2025 |

PhysicsWallah IPO Lot Sizes:

The company PhysicsWallah is raising ₹3480 crore from investors through financial markets. Retail investors can bid for a minimum of 137 shares (1 lot) in this IPO. Like every IPO, the PhysicsWallah IPO also has minimum and maximum investment limits for individual investors (retail) and high net worth investors (HNIs) in terms of shares and amount. Let us take a look at the prescribed amounts for different investor slabs.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 137 | ₹ 14,933 |

| Retail (Max) | 13 | 1,781 | ₹ 1,94,129 |

| S-HNI (Min) | 14 | 1,918 | ₹ 2,09,062 |

| S-HNI (Max) | 67 | 9,042 | ₹ 9,85,578 |

| B-HNI (Min) | 68 | 9,179 | ₹ 10,00,511 |

Investor category and their reservation:

| Investor Category | Reservation |

| Qualified Institutional Buyers (QIBs): | 75% ( 23.95 Crore shares ) |

| Non-Institutional Investors (NIIs/HNIs): | 15% (4.79 Crore shares ) |

| Retail Individual Investors (RIIs): | 10% (3.19 Crore shares ) |

Utilisation of Proceeds

| Purpose | Values in Cr |

| Capital expenditure on new offline and hybrid centres | ₹460.5 (14.9%) |

| Lease payments of existing centres | ₹548.3 (17.7%) |

| Expenditure for fit-outs of new Xylem offline centres | ₹31.65 (1.02%) |

| Expenditure towards lease and hostel payments | ₹15.52 (0.50%) |

| Investment in Utkarsh Classes for lease payments | ₹33.70 (1.09%) |

| acquire additional shareholding in Utkarsh Classes | ₹26.50 (0.85%) |

| Investment in server and cloud infrastructure | ₹200.11 (6.46%) |

| Investment towards marketing and brand-building initiatives | ₹710 (22.9%) |

| Expenditure on inorganic growth and general corporate purposes | 1073.66 (34.6%) |

What is PhysicsWallah? (Company overview)

Physics Wala Limited (PW) is one of the fastest-growing EdTech companies in India. Physicswala was founded by Alakh Pandey and Pratik Maheshwari in 2016. The company started as a small YouTube channel that provided free online lectures on physics and other science subjects for students preparing for competitive exams like JEE and NEET.

Over the past few years, the company has evolved into a complete edtech ecosystem, offering structured learning through its digital platform, offline centres and hybrid learning model.

The company operates its flagship learning app and website – the PW app and PW Live – which provide live classes, recorded lectures, doubt-solving sessions, and study materials at highly affordable prices.

By FY2025, the company will have built a strong physical presence by opening over 303 offline and hybrid centres across India, covering major cities.

PW also operates several subsidiaries and acquired brands such as Xylem Learning, Utkarsh Classes and Knowledge Planet, which strengthen its position in various learning categories.

PhysicsWallah Ltd. Financial Overview

Here is the company’s financial information for the last three years:

ALL values in crores –

| Periods Ended | FY25 | FY24 | FY23 |

| Total Revenue | 2,887 | 1,941 | 744 |

| Profit After Tax | -243 | -1131 | -84 |

| Net Worth | 1,945.4 | -861.79 | 62.29 |

| Total Assets | 4156.38 | 2480.74 | 2082.18 |

| Reserve and Surplus | 467 | -1245.7 | -187.7 |

| EBITDA Margin | 6.69% | -42.7% | 1.86% |

| PAT Margin | -8.43% | -58.28% | -11.30% |

| Debt / Borrowings | 0.30 | 956.15 | 1687.4 |

| Return on Equity (RoE) | 15.97% | _________ | _________ |

PhysicsWalla Limited reported revenue of ₹744 crore in FY23, which increased to ₹1,941 crore in FY24, a growth of 161%. In FY25, revenue grew to ₹2,887 crore, a growth of 49% over FY24. PhysicsWallah’s operating revenue has grown by 290% over two financial years.

Physics Wallah reported a net loss of ₹84 crore in FY23, which widened to a loss of ₹1131 crore in FY24 – a huge decline in terms of PAT. In FY25, the company reported a net loss of ₹243 crore, a huge recovery compared to FY24.

Strengths of PhysicsWallah

PhysicsWallah Limited’s strength lies in its deep brand trust and educational credibility within the competitive exam preparation segment across India. The company has built a huge fan following through affordable and high-quality education. 4.46 million Total Number of Paid Users in Fiscal 2025, grew at a CAGR of 59.19% from fiscal 2023 to 2025

PhysicsWallah has shown consistent revenue growth and improved profitability metrics over the last few financial years. From ₹744 crore in FY23 to around ₹2,886 crore in FY25, its top line has grown almost fourfold in just two years. Its debt reduction from ₹1,687 crore in FY23 to almost non-existent levels in FY25 further reflects the management’s prudent capital allocation strategy.

The company has built a robust hybrid model that combines online convenience with offline learning experience across 303 centres in India. With 4.13 million online users and 0.33 million offline students, PW has developed a balanced ecosystem that ensures continuous learning growth.

The company records an average collection of ₹3,930.55 per user, which reflects strong monetisation and user loyalty.

PW has 6,267 faculty members and a total of 18,028 employees, reflecting its strong academic and operational backbone.

It offers courses in 13 education categories, covering major competitive and school-level exams across the country. Having published 4,382 books, PW has become a trusted content creator and knowledge distributor beyond digital platforms.

Risks Involved in PhysicsWallah IPO

In FY24, PhysicsWallah reported a net loss of ₹1,131 crore, a major financial blow to the company. Although losses narrowed to ₹243.3 crore in FY25, profitability is still uncertain, posing a risk to investors.

The company’s heavy dependence on enrolment for competitive exams like JEE and NEET makes its revenue cyclical. Any decrease in the number of exam takers or policy change can have a direct impact on the company’s earnings.

The acquisition of PW, including the stake in Utkarsh Classes, involves integration and execution risks if synergies fail. Its aggressive inorganic growth and expansion strategy could strain management focus and financial discipline.

PW’s revenue grew from ₹744 crore in FY23 to ₹2,886 crore in FY25, but its profitability remains volatile. Unless operating efficiency improves, it may be difficult to maintain long-term investor returns.

The Conclusion

PhysicsWallah’s IPO journey from a small online eyewear startup to one of India’s most famous edtech brands. PhysicsWallah IPO offers an attractive investment opportunity in the Edtech industry. Its expansions, along with strategic acquisitions and offline presence, position it for long-term growth. The company has achieved consistent revenue growth over time and is improving its debt.

You can invest in the PhysicsWallah IPO, but do so at your own risk, only after thoroughly researching the company, analysing its financial reports, and understanding its business model. Short-term investors may see some gains from the listing, while long-term investors could benefit from the company’s continued growth in the Ed-tech sector.

Frequently Asked Questions

What is the price band of the PhysicsWallah IPO?

The PhysicsWallah IPO price band is ₹ 103 to ₹ 109 per share.

What is the lot size and minimum investment.

Each lot contains 137 shares, making the minimum investment ₹14,933 at the upper price band.

When does the PhysicsWallah IPO open and close?

The PhysicsWallah IPO Opens For subscription period from November 11, 2025, and it will close on November 13, 2025.

What is the total issue size of the PhysicsWallah IPO?

The total IPO size is ₹ 3,480 crore, including ₹ 3,100 crore as a fresh issue and ₹380 crore via Offer for Sale (OFS) by promoters.

When will PhysicsWallah Company shares be allotted to investors?

The Share of PhysicsWallah Company allotted to investors on Tue, November 14th 2025.

On which stock exchanges will the PhysicsWallah IPO be listed?

The PhysicsWallah IPO is going to list on both the NSE AND BSE exchanges

I love this type of post because it’s so understandable and easy. Thank you unity wealth capital for providing this type of artical

This post is very helpful for me and my investment thankyou prabhat mehta 😊