Mutual funds have become one of the most popular investment options for investors in India, especially those who want to accumulate wealth but don’t have the knowledge or time to select stocks or bonds, as they offer the opportunity to grow their wealth without having to choose individual stocks or bonds.

The structure of mutual funds makes them suitable for almost every type of investor—whether a young investor planning for long-term wealth creation, a parent saving for their child’s future, or someone preparing for retirement and seeking to achieve their financial goals, there’s a mutual fund for you.

Mutual funds pool money from many investors and invest it in a diversified portfolio managed by professional fund managers who have the skills, experience, and tools to make informed investment decisions.

However, to choose the right mutual fund, it’s crucial to understand the different types of mutual fund schemes available in the market, as each category is designed with a specific objective, risk level, time horizon, and investment objective in mind.

Without understanding the different categories, investors often end up choosing unsuitable funds and end up disappointed. This article will provide you with information about the types of mutual fund schemes, their categories, structure, objectives, and everything you need to know before investing in them.

What is a Mutual Fund?

A mutual fund is a collective investment scheme that pools money from many individual and institutional investors and invests it in a diversified portfolio of securities such as stocks, bonds, money market instruments, gold, and other asset classes.

Mutual funds are created by an asset management company (AMC), and the funds collected through the mutual fund are managed by professional fund managers working under the AMC. Expert fund managers are responsible for selecting securities, allocating assets, managing risk, and generating returns.

A mutual fund’s performance is reflected in its net asset value (NAV), which fluctuates daily based on the value of its underlying assets minus liabilities. The NAV changes daily because the market value of the securities within the mutual fund also fluctuates daily. Therefore, investors can purchase or redeem mutual fund units only at the net asset value (NAV), which is announced at the end of each business day.

Mutual funds are primarily preferred because they offer diversification, professional management, liquidity, affordability, and easy access to various markets. But the real advantage of mutual funds is the variety of plans available to suit different needs. This is where understanding the types of mutual fund schemes becomes essential.

Types Of Mutual Fund Schemes:

Mutual fund schemes can be classified into the following categories:

Mutual fund based on investment objectives

Mutual fund based on Asset class

Mutual fund based on structure

Mutual Funds Based On Asset Class (Principal Investments):

Each type of mutual fund scheme features a distinct investment strategy and asset allocation. Each scheme is designed to meet specific investor needs. Schemes are classified into the following categories:

- Equity mutual fund schemes

- Debt mutual fund schemes

- Hybrid mutual fund scheme

- Solutions-oriented mutual fund schemes

- Other schemes

A. Equity Mutual Fund Schemes:

Equity mutual fund schemes are those that primarily invest in stocks or equities to generate capital gains and build wealth over the long term. Due to market volatility, equity mutual funds are considered a very risky investment option, but they offer the potential for high returns over time.

According to SEBI guidelines, an equity mutual fund must invest at least 65% of its total assets in equity and equity-related instruments. Within equity funds, there are several sub-categories:

Sub-category Of Equity Mutual Fund:

1. Large Cap Mutual Funds:

According to SEBI, the top 100 companies listed on exchanges in India (based on market capitalisation) are large-cap stocks. Therefore, these mutual funds invest in large, established, and financially strong companies with stable performance records.

These large-cap stocks are less volatile than smaller stocks. These funds are required to invest at least 80% of their assets in equity and equity-related instruments of large-cap companies. Investors who seek a blend of safety and steady appreciation often rely on large-cap funds as the foundation of their equity portfolio.

2. Mid Cap Mutual Funds:

Mid-cap companies are ranked between 101-250 in terms of market capitalisation. These mutual funds invest in these mid-cap companies. These are the riskiest equity funds due to market volatility and sensitivity, but they are growth-oriented companies with the potential to become large-cap stocks in the future. As mid-cap companies work toward becoming the next generation of large corporations, they often experience faster revenue growth and market recognition.

These mid-cap funds invest at least 65% of their assets in equity and equity-linked mid-cap companies.

3. Small Cap Mutual Funds:

Small-cap companies ranked beyond the top 250 by market capitalisation. These mutual funds invest in these small-cap companies. These are the riskiest equity funds due to their volatility, but they offer excellent growth potential.

These companies are usually new, emerging, or innovative businesses with high growth potential. Because small-cap firms operate on a smaller financial base, they are more sensitive to market risks, regulatory changes, and competitive pressures.

These small-cap funds must invest at least 65% of their assets in equity and equity-linked small-cap companies.

4. Multi-Cap Mutual Funds:

As per SEBI guidelines, multi-cap funds must invest at least 75% of their total assets in equities, with a minimum of 25% each in large-, mid-, and small-cap stocks. This ensures a diversified approach, spreading investments across large-cap, mid-cap, and small-cap stocks, providing a mix of stability and growth. This ensures balanced diversification.

These funds are ideal for investors who want regulated diversification without investing in multiple separate funds.

5. Flexi Cap Mutual Funds:

Flexi-cap mutual funds have no investment limits or limits on specific market capitalisations. Flexi-cap funds offer the flexibility to invest in companies of any market capitalisation or in any sector without any fixed allocation rules. The fund manager has the discretion to adjust the portfolio based on market dynamics. These funds allow dynamic allocation depending on market conditions.

There are no investment rules or restrictions in these funds; fund managers use their experience to make investments. These funds are ideal for investors seeking dynamic diversification.

6. Large & Midcap Mutual Funds:

These mutual funds invest their assets in large- and mid-cap companies. These mutual funds are required to invest at least 35% of their assets in equity and equity-related large-cap funds. They are also required to invest at least 35% of their assets in equity and equity-related mid-cap funds.

7. Dividend Yield Funds:

An equity mutual fund that invests its assets in dividend-paying stocks is called a dividend yield fund. These funds are required to invest at least 65% of their total assets in equities and 35% in various other financial instruments.

8. Sectoral & Thematic Funds:

These mutual fund schemes invest their assets in a single sector, such as technology, FMCG, banking, defence, and financials. These are highly risky funds because they invest in a single sector across a diverse range of companies. Therefore, these funds depend on the success of that sector/industry.

9. ELSS (Equity Linked Saving Scheme) Funds:

ELSS funds are equity-based mutual fund schemes specifically designed for tax savings under Section 80C. With a mandatory lock-in period of three years, ELSS funds encourage disciplined long-term investing. The lock-in period reduces emotional decision-making and prevents premature withdrawals, allowing investments to grow more effectively. Since ELSS funds have no upper investment limit and are available through SIPs or lump sum investments, they are widely preferred by young professionals seeking wealth creation and tax benefits.

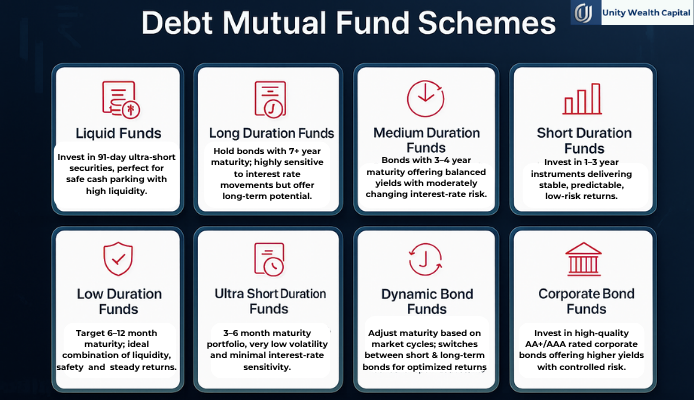

B. Debt Mutual Fund Schemes:-

Debt mutual funds invest in fixed-income instruments such as corporate and government bonds, debentures, treasury bills, and other money market funds. Debt mutual funds are considered less risky than equity mutual funds. However, these funds are not completely risk-free; they are exposed to interest rate and credit rate risks. These funds are designed to provide stability, liquidity, and predictable returns compared to equity funds. Debt mutual funds are less affected by stock market volatility but are affected by fluctuations in interest rates.

Some popular categories of debt mutual fund schemes:

1. Liquid Funds :

These funds invest in ultra-short-term debt and capital market securities with a maturity period of only 91 days. These funds are ideal for investing your excess cash with minimal risk. Individuals and businesses widely use them for parking large amounts of cash that might be required on short notice. Liquid funds usually offer better returns than a normal savings account, while maintaining the ability to withdraw money quickly

2. Long Duration Funds :

Long-term funds invest in debt (bonds) and money market instruments. They target securities with maturities greater than 7 years. These funds are suitable for investors who are comfortable with interest rate fluctuations.

3. Medium Duration Funds :

These medium-term debt funds invest in debt financial instruments with maturities of 3 to 4 years. They are sensitive to interest rate changes but offer higher yields.

4. Short Duration Funds :

Short-term debt funds invest in debt instruments with maturities ranging from 1 to 3 years. These funds offer moderate returns with moderate risk. These funds are suitable for individuals seeking stable, predictable growth for medium-term financial goals. These funds perform well in environments where interest rates remain stable or decline, making them popular among conservative investors looking for an alternative to fixed deposits.

5. Low Duration Funds :

Short-duration debt mutual funds invest in bonds and money market instruments. These funds typically have a maturity period of 6-12 months. This helps them strike an ideal balance between liquidity, safety, and the potential for moderate returns. These funds strike a middle ground between low-risk liquidity funds and high-return short-duration funds, and offer stable growth over a period of 6-12 months.

6. Ultra Short Duration Funds:

These funds invest in financial instruments with maturities ranging from 3 to 6 months. These funds offer slightly higher returns than liquid funds and carry lower risk. Their shorter maturity period makes them less sensitive to changes in interest rates, resulting in stable and predictable performance. These funds are ideal for investors who want to invest for a few months without taking on significant risk.

7. Dynamic Bond Fund :

A dynamic debt mutual fund scheme that invests across different tenors means it adjusts its portfolio according to interest rate trends, aiming to maximise returns. These funds allow fund managers to alternate between short-term and long-term bonds for optimal returns. While they offer the potential for high returns, they can also be moderately volatile due to dynamic tenor changes. These mutual fund schemes are suitable for medium-term investors who can tolerate some volatility for better returns.

8. Corporate Bond Funds:

Corporate bond debt funds invest in highly rated corporate bonds, typically AA+ or AAA rated, which offer better returns than government securities with moderate risk. These mutual fund schemes offer higher returns than government securities while maintaining a moderate risk level due to strong credit quality. Their performance is affected by fluctuations in interest rates and the financial stability of the issuing companies.

9. Credit Risk Funds :

Credit risk debt funds invest in lower-rated corporate bonds for higher returns. These are high-risk debt funds. These funds focus on generating additional returns by investing in companies that are not highly rated but have the potential to improve their credit profile over time. These mutual fund schemes are only suitable for investors who understand the risks and are comfortable with short-term fluctuations for potentially larger gains.

10. Gilt Debt funds :

Gilt debt funds invest solely in government securities until maturity. These funds carry no credit risk, but are sensitive to interest rate fluctuations. Although they are considered safe from default, they can still be sensitive to interest rate fluctuations, especially when holding long-term bonds.

C. Hybrid mutual fund schemes :

Hybrid funds invest in both equity and debt instruments. They aim to balance risk and return by diversifying investments across different asset classes. They are designed to provide both growth and stability, making them ideal for investors who want diversified investments without actively managing asset allocation.

Some categories of hybrid mutual fund schemes:

1. Conservative Hybrid Funds :

Conservative hybrid funds invest 10-25% of their assets in equity and equity-related instruments and 75-90% in debt instruments. These funds prioritise safety with growth potential. These mutual fund schemes are ideal for those seeking stable returns with a small investment in equities for additional growth.

2. Aggressive Hybrid Funds :

Aggressive hybrid funds invest 65-80% of their assets in equity and equity-related instruments and 20-35% in debt instruments. These funds prioritise rapid growth over safety and stability. These funds focus on stock market growth while using debt instruments to mitigate risk. They are ideal for moderate-risk investors who want to participate in equity growth but prefer less volatility than pure equity funds.

3. Balanced Hybrid Funds :

Balanced hybrid funds invest 40-60% in equities and 40-60% in debt instruments. No arbitrage would be allowed in this type of mutual fund schemes. When market valuations are high or risky, the fund increases its debt allocation to protect the portfolio. When market valuations are low, the fund increases its exposure to equities to take advantage of growth opportunities.

4. Dynamic asset allocation funds :

A hybrid mutual fund that varies its equity and debt investments based on market conditions. These funds are also called balanced advantage funds. These funds follow a model-based approach, so the equity-debt mix keeps changing without the investor having to take any action. Because of this flexibility, they offer a balance of growth and stability over the long term.

5. Multi-asset Allocation Funds:

These hybrid mutual fund schemes invest in at least three asset classes, with a minimum of 10% invested in each asset class (equity, debt, gold, real estate, and foreign investments). By spreading money across multiple assets, these funds reduce overall risk and create a more stable investment experience, even when one market is not performing well.

6. Arbitrage Funds:

These types of mutual fund schemes invest in arbitrage opportunities. These take advantage of price differences in equity markets (e.g., cash versus futures) and provide low-risk, tax-efficient returns. Since they depend on market inefficiencies rather than market direction, their returns remain stable even during volatility.

D. Solution-Oriented mutual fund Schemes :

These funds are designed for a specific goal or have a lock-in period for disciplined investing. Solution-oriented funds come with a mandatory lock-in period.

1. Retirement Funds:

A retirement solution-oriented plan with a lock-in period of 5 years or till retirement age, and invests in equity and debt funds. These typically hold a mix of equity and debt, and gradually move from an equity-heavy to a debt-heavy allocation as retirement approaches. The disciplined structure ensures long-term compounding interest and discourages premature withdrawals.

2. children’s funds:

A scheme investing for children having a lock–in for at least 5 years or till the child attains his age of majority. These funds maintain a diversified portfolio that grows steadily over the investment horizon. Because children’s future expenses are long-term, these funds often include equity exposure for growth, combined with debt for stability.

Other Fund :

1. Index mutual Fund :

These index funds passively track indices like the Nifty 50 and Sensex and provide low-cost exposure to the market. These are passive funds, meaning their goal is to match the market, not beat it. They offer simplicity, diversification, and low cost. These funds do not rely on a fund manager’s stock-picking skills but follow a passive strategy that mirrors market performance.

2. FOF’s funds :

These are the fund-of-fund mutual funds that invest in other top-performing mutual funds. Minimum investment in the underlying fund – 95% of total assets. FOFs give investors instant diversification across multiple fund categories and strategies through a single investment.

Some Useful Points To Consider Before Investing:

Investing in mutual funds is a wise financial decision, but before investing, it’s important to understand a few things that will reduce future risk and increase returns. Before starting a mutual fund investment, every investor should consider a few things:

1. Define your financial goals:

Before you start investing, you should be clear about your financial goals, whether you want to invest to achieve short-term goals or build long-term wealth. Your goals will help you choose the right mutual fund that will help you achieve your goals.

2. Risk tolerance:

Understand your comfort level well, as each mutual fund has a different risk level. Equity funds can be volatile, while debt funds are relatively stable. Hybrid funds are balanced in terms of risk and return. Choose a plan that suits your comfort level with market fluctuations.

3. Always consider the expense ratio and exit load:

The expense ratio is an annual fee that the mutual fund house charges every year for managing your money. The exit load is a penalty levied when you redeem your funds from the mutual fund before a certain deadline.

4. Diversify Your Investments :

Don’t put all your money into a single fund or basket. Divide your funds across different types of funds. This will reduce portfolio risk and allow you to diversify across different segments.

5. Check Past Performance:

Before investing in any mutual fund, you should check its past performance. This will help you understand how the fund has performed over different market cycles. Compare the fund’s returns to its benchmark and category average over 3, 5, and 10 years.

But don’t rely on past performance; “it will never be the same.”

6. Be aware of the tax implications:

Mutual funds are subject to capital gains tax based on their holding period. If you earn a profit on your investment and redeem it, you will have to pay tax on that profit.

• Equity Funds: These funds offer tax-free long-term (over one year) capital gains up to ₹1.25 lakh per year. After ₹1.25 lakh, 12.5% tax will be deducted on the gain. If redeemed before 12 months, you will have to pay 20% tax as per LTCG.

Dividends: Taxed at the investor’s slab rate. • Hybrid Funds: STCG: Taxed at 20% if sold within 12 months. LTCG: Taxed at 12.5% if held for more than 12 months.

Dividends: Taxed at the investor’s slab rate.

Which Mutual Fund is Best for You?

The best mutual fund for you depends on your personal financial goals, investment horizon, and risk appetite. Let’s break this down to help you make the right choice.

1. For Short-Term Goals:

If you are planning to invest for short-term goals like buying a car, going on a vacation, or building an emergency fund, capital protection and liquidity should be your top priorities.

Best-suited mutual funds:

- Liquid Funds

- Ultra Short Duration Funds

- Low Duration Debt Funds

These funds invest in low-risk instruments and offer us better returns than any traditional asset class.

2. For Medium-Term Goals:-

If your goals are to save for a child’s education or payment of any loan, then you need to take a bit risky step for investments to fulfil your financial goals. A balance between growth and stability is key here.

Best-suited mutual funds:

- Short Duration Debt Funds

- Hybrid Funds (Aggressive or Conservative)

- Balanced Advantage Funds

- Multi Asset Funds

These funds offer a mix of equity and debt, helping you grow your money while managing risk through diversification.

3. For Long Term Goals –:

If your vision is for long-term wealth creation, like planning for retirement, saving for a child’s education, wanting to buy a dream home and cars or wanting to build long-term wealth for financial freedom. Then you should invest in the equity mutual funds.

Best Equity mutual funds:

- Large Cap Funds – For steady growth with relatively lower volatility.

- Flexi Cap or Multi Cap Funds – For dynamic and diversified exposure.

- Mid Cap or Small Cap Funds – For higher risk and potentially higher returns.

- ELSS Funds – For tax-saving with equity exposure.

Investing through SIP (Systematic Investment Plan) over a long period helps in compounding your wealth and managing market volatility through rupee cost averaging.

Final Conclusion:-

AT First, you need to choose your goals/purpose for investing. Then also clarify your risk appetite or time horizon for investing. Then you can focus on choosing a fund that aligns with your goals, your time horizon, and your risk tolerance. There is a fund that is suitable for your goals. Choose that fund and start your investment journey from today.

Always review your portfolio regularly, and if needed, then you can rebalance your portfolio according to the changes in your goals, income and risk tolerance. However, choosing the right mutual fund scheme is not just about looking at past returns. It requires a thoughtful understanding of your own financial goals, risk capacity, and investment horizon.

If you are just starting your financial journey, start small, but start early. A Systematic Investment Plan (SIP) is one of the smartest ways to begin — it takes financial discipline, takes advantage of rupee cost averaging, and harnesses the power of compounding over time. Even ₹500 a month invested regularly can turn into a substantial corpus over the years.

4 thoughts on “Types of Mutual Fund Schemes: Category, structure and their investment objective”