The company Canara Robeco AMC (CRAMC) has launched its book-built IPO from 9-13 October 2025. Canara Robeco IPO issue is an entirely offer-for-sale (OFS) of 4.99 crore shares at a price band of ₹253-₹266, aiming to raise ₹1,326.13 crore (all proceeds to selling shareholders) from investors. As per the upper band price, the estimated market valuation of the issue is around ₹5,300 crore.

The company specializes in managing mutual funds and investment portfolios with over 30 years of experience. Canara Robeco AMC has grown into a strong player known for steady profitability, consistent AUM growth, and a solid distribution network. The AMC is primarily retail-focused and equity-oriented, with significant AUM expansion in recent years—though this involves an OFS (promoters partially exiting).

In this detailed article, we will deep dive into the company overview, important dates related to IPO, numbers, charts, valuation, risks, and subscription strategies.

Canara Robeco IPO: Important Dates and Timelines

The Canara Robeco IPO bidding will open for subscription on October 9, 2025, and will close on October 13, 2025. The Canara Robeco IPO will be listed on both the BSE and NSE exchanges, with an expected listing date of October 16, 2025.

The Canara Robeco IPO price band has been set at ₹253.00 to ₹266.00 per share. The lot size for the application is 56. Hence, the minimum investment amount required by a retail investor is ₹14,896 (56 shares) (based on the upper price band). The lot size investment for SNII is 14 lots (784 shares), amounting to ₹2,08,544, and for BNII, it is 68 lots (3,808 shares), amounting to ₹10,12,928.

Let’s look at some important details related to Canara Robeco IPO :

| Parameters | Details |

| IPO Open Date | 9 October 2025 |

| IPO Close Date | 13 October 2025 |

| Issue Price range | ₹ 253 to ₹ 266 per equity share |

| Face Value | ₹10 per share |

| Lot Size | 56 shares per lot |

| Total Issue Size | ₹ 1,326.13 Crore (ALL OFS) |

| Offer For Sale | ₹ 1,326.13 Cr ( 4.99 crore shares) |

| Promoter / Seller Shares | Canara Bank and ORIX Corporation (promoters) sell their stakes. |

| Registrar | MUFG Intime India Private Limited |

| Lead Managers | SBI Capital Markets, Axis Capital, JM Financial |

| Listing At | NSE Or BSE |

Canara Robeco IPO GMP (Grey Market Premium)

The Grey Market Premium (GMP) of the Canara Robeco IPO is ₹ 35 per share as of 9 October 2025, giving an estimated listing price of ₹ 301, which implies a listing gain of about 13.16% over the upper band of ₹ 266. Let’s look up the previous day’s GMP of the Canara Robeco IPO.

| Date | GMP | Est. Listing Price | Listing Gain |

| Oct 6 | 20 | 7.52% | 286 |

| Oct 7 | 25 | 9.40% | 291 |

| Oct 8 | 35 | 13.16% | 301 |

| Oct 9 | 35 | 13.16% | 301 |

Canara Robeco IPO Important Timelines:

The Canara Robeco IPO is open for subscription from October 9, 2025, and will close on October 13, 2025. The allotment for the Canara Robeco IPO is expected to be finalized on October 14, 2025. The IPO is going to be listed on both the BSE and NSE exchanges, with a tentative listing date of October 16, 2025.

| IPO Open Date | Thu, 9 October 2025 |

| IPO Close Date | Mon, 13 October 2025 |

| Allotment Date | Tue, 14 October 2025 |

| Initiation of Refund | Wed, 15 October 2025 |

| Shares Credit to Demat | Wed, 15 October 2025 |

| Listing Date in Exchange | Thu, 16 October 2025 |

Canara Robeco IPO Lot Sizes

Canara Robeco is raising ₹ 1,326.13 Crore from investors via the financial markets. Retail investors can bid for a minimum of 56 shares (1 lot) in the IPO. As with every IPO, in the Canara Robeco IPO, there are minimum and maximum investment limitations for individual investors (retail) and high net worth investors (HNIs) in terms of shares and amount. Let’s take a look at the amounts set for various investor slabs.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 46 | ₹ 14996 |

| Retail (Max) | 13 | 728 | ₹ 1,93,648 |

| S-HNI (Min) | 14 | 784 | ₹ 2,08,554 |

| S-HNI (Max) | 66 | 3,752 | ₹ 9,98,032 |

| B-HNI (Min) | 67 | 3,808 | ₹ 10,12,928 |

Investor category and their reservation:

Qualified Institutional Buyers (QIBs): 50% ( 2.45 crore shares reserved) Individual Investors (RIIs): 35% (1.71 crore shares reserved) Non-Institutional Investors (NIIs/HNIs): 15% (0.735 crore shares reserved)

What is Canara Robeco? (Company Overview)

Canara Robeco Asset Management Company (known as Canara Robeco Mutual Fund) is one of the most trusted mutual fund brands in India. It was founded in 1993. In 2007, the company became a joint venture between Canara Bank (51%) and Orix Corporation Europe N.V. (49%), part of the Robeco Group. The company is headquartered in Mumbai, Maharashtra, India.

The AMC has expanded to manage 26 schemes across equity, debt, and hybrid categories for retail and institutional investors, with a particularly retail-heavy franchise (with a large portion of AUM from individual investors).

By mid-2025, Canara Robeco Asset Management Company was managing 26 schemes (12 equity, 10 debt, 4 hybrid) and had registered rapid growth in AUM over the last two to three financial years.

Some Key Stats of the company:

- 259 nationwide distributors and 44 banking partners, including Canara Bank.

- 25 departments across major Indian cities and union territories.

- 49,108 mutual fund distributors.

- Total Schemes Managed: 12 equity, 10 debt, 4 hybrid (26 Total)

- Retail and HNI Asset Under Management Share: 86.87% of the total AUM of the company.

Canara Robeco IPO Financial Information

Canara Robeco AMC operates on a low-asset, high-margin business model, earning management fees primarily from its AUM. Its strong retail bias is reflected in its high proportion of equity assets under management (91.69% in FY2025), making it one of the most equity-heavy AMCs in the country. Since it invests mostly in equities, the management fees it charges are very high, which makes it highly profitable.

All Values in Crores :

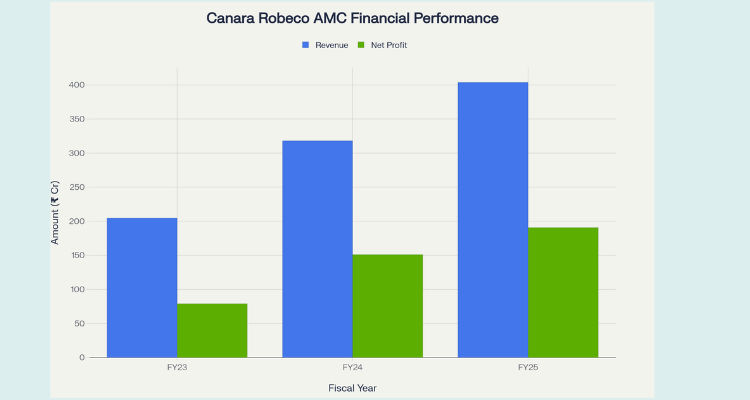

| Periods Ended | 31 March 2025 | 31st March 2024 | 31st March 2023 |

| Total Income | 403.69 | 318.78 | 204.80 |

| Profit After Tax | 190.7 | 151 | 79 |

| Net Worth | 600.06 | 454.49 | 328 |

| Total Assets | 674 | 516.81 | 377.95 |

| Reserve and Surplus | 400.64 | 404.64 | 278.7 |

The company has seen a consistent increase in revenue and profit after tax. Revenue from operations increased from ₹ 204.8 Cr in FY23 to ₹ 403.69 Cr in FY25. The profit after tax of the company doubled from FY22 to FY25.

Canara Robeco AMC claims to have invested heavily in a digital ecosystem aimed at empowering customer engagement and service access. The company claims that its mobile application, Canara Robeco Mutual Fund App, has experienced 7,00,000 downloads as of June 30, 2025. Canara Robeco offers smart investing through its website “SmartInvest”.

Risks Involved in Canara Robeco IPO

Before investing in this IPO, you should be aware of the following risks involved in the IPO:

Purely an OFS – wherein the promoters are selling their stake in the company. Since this IPO is entirely for sale, the proceeds go to the selling shareholders and not to the AMC for growth capital expenditure.

High equity concentration: Creates market sensitivity. With over 90% of QAAUM being equity-oriented in equity segments, revenues and flows are cyclically sensitive to equity market fluctuations. Market corrections will sharply impact fees and flows.

Competition and scale: India’s AMC market is consolidated at the top; Growth requires improved products, distribution, and performance to attract flows from larger rivals.

Regulatory Challenges: SEBI’s changes in management fees, commissions, or TER could impact profitability.

If you want to learn about Cryptocurrency, you can learn from here

Notes for investors before applying for the IPO

Remember, this is an OFS – the company doesn’t receive the new capital from the IPO, but rather it is sold to shareholders. The company will not receive any capital to expand its business and services.

Pay attention not only to GMPs, but also to fundamentals. Focus on long-term revenue factors (AUM mix, distribution reach, expense ratio, performance track record of leading equity schemes). Then think about investing in the company.

If you want a short-listing advantage: GMP and anchor allocations indicate early interest – but these can reverse quickly. Use only a fraction of your allocation for speculative listing bets.

If you want long-term ownership, evaluate the company’s fee economics, ability to improve margins, and the flexibility of retail flow through cycles. Consider applying only if you are comfortable with sector cyclicality and promoter liquidity (OFS).

The Conclusion

Canara Robeco AMC’s IPO gives common investors access to a retail-driven, equity-focused AMC that is generating profits and rapidly growing AUM. However, since the issue is purely an OFS and the company’s earnings are sensitive to market cycles (high equity concentration).

You can invest in its IPO, but do so at your own risk, after thoroughly researching the company, analysing its financial reports, and its business model. Short-term investors may see modest gains from the listing, while long-term investors may benefit from the company’s continued growth in financial services.

Frequently Asked Questions

What are the Canara Robeco AMC IPO dates?

The IPO opens for subscription on October 9, 2025, and closes on October 13, 2025. The allotment will be finalized on October 14, 2025.

What is the price band for the IPO?

The price band for the Canara Robeco AMC IPO is Rs 253 – Rs 266 per share. Investors can bid within this range depending upon their preference and strategy.

What is the issue size of the Canara Robeco AMC IPO?

The IPO consists entirely of an Offer for Sale (OFS) of 4.99 crore shares, amounting to approximately ₹1,326 crore.

Who are the promoters of Canara Robeco AMC?

The company is promoted by Canara Bank and ORIX Corporation Europe N.V.

Who is the registrar of the Canara Robeco IPO?

The Registrar of Canara Robeco IPO is MUFG Intime India Private Limited.