The capital markets are a very important part of any economy. Capital markets provide services for buying and selling shares, bonds, equities and other currencies. When businesses and governments need funds for long-term projects and business expansion, they raise capital from investors through the capital market in exchange for shares, bonds (certificates), and other financial assets.

In this article, we will learn everything about capital markets, such as their meaning of capital markets, their functions, and why they are important for every economy. If you’re a student, investor, or simply interested in learning about the capital markets, this guide is for you.

What is the Capital Market?

The capital markets are a place or platform that facilitates savings and investments between suppliers and those who need them.

Any business or government needs only two types of loans for the growth and success of their business. These are usually short-term working capital and long-term fixed working capital. Companies take loans from the money market to meet their short-term working capital needs. But for long-term liabilities, companies raise funds from the capital market by issuing their shares, bonds, and debentures.

In the capital markets, suppliers such as banks and investors provide capital for investments and businesses, and governments seek capital in this market. The purpose of the capital market is to improve transaction efficiency by bringing suppliers and investors together and facilitating their share exchange.

The capital markets allow us to buy and sell stocks, bonds, debentures, mutual funds, ETFs, and other financial assets.

How Does the Capital Market Work?

The capital markets help the economy grow by providing a structured ecosystem to raise funds for business growth, projects, and public welfare, and by offering investors a platform to build their immense wealth.

The capital markets serve as a dynamic engine, channelling idle savings into productive economic activities by investing in businesses.

The capital market is used to buy and sell financial assets such as shares, bonds, and debentures.

The entire capital markets are regulated by [SEBI], i.e. Securities and Exchange Board of India. SEBI makes rules, regulations and laws for every part of the capital market, such as the stock market, bond market and financial market. SEBI protects investor returns, prevents fraud and maintains fair trading practices.

The capital markets work smoothly with the help of SEBI, AMCs, capital ventures, investors, companies, governments, stockbrokers, and merchant bankers. These entities facilitate trading in demat form of securities, handle settlements and maintain transparency in transactions.

Types Of Capital Markets

There are two types of capital market –

1. primary market

2. secondary market

1. primary market

When a company sells its shares and bonds to the public for the first time, this activity takes place in the primary market through an IPO (Initial Public Offering).

This market is also called the “New Issue Market”. The primary market is a direct channel where companies and governments raise funds in exchange for shares and bonds.

A company that offers securities/wishes to raise funds hires an underwriting firm to represent investors who purchase the company’s securities. The firm reviews it and prepares a prospectus stating the price and other details of the securities to be issued.

The company and its investment banker want to sell all of their securities in the shortest possible time to meet the volume. They typically focus on investors who buy a large number of securities at once. Therefore, small investors are unable to buy new securities from the market.

The primary market plays a vital role in bringing new investment opportunities to the public and is the first step for companies entering the public market space.

2. Secondary Market

The secondary market is a place where investors and traders trade existing stocks and bonds. Investors can buy and sell shares in the secondary capital market through stock exchanges such as the National Stock Exchange (NSE), Bombay Stock Exchange (BSE), and New York Stock Exchange (NYSE).

Stock exchanges provide us with the service of buying and selling shares of publicly listed companies. If you own shares of an existing company and want to sell those shares for cash or book your profits, these stock exchanges help us complete the transaction.

In the secondary market, companies are not directly involved in the transaction of buying and selling shares. So if you are buying shares from the secondary market, you are not buying shares directly from the companies.

You are buying shares from an investor or trader who sold the shares at the same price you are buying them.

Elements of the Capital Market

1. Capital markets are run by governments, stock exchanges, stock brokers, investment bankers, asset management companies, investors and venture capitalists.

2. The capital markets trade long-term investments in stocks, bonds, debentures, government securities, derivatives and mutual funds.

3. Here, companies and governments raise funds from investors by issuing shares and bonds to raise capital. They use these funds for projects, business growth and scale, new ideas and public welfare.

4. Individual investors, asset management companies, foreign institutional investors and banks invest their money with the intention of earning capital gains as their investments grow over time.

5. The capital markets are operated and regulated by SEBI (Securities and Exchange Board of India). It is responsible for monitoring and eliminating any illegal activities in the capital market. And SEBI also ensures transparency, protects investors, and maintains fair practices in the market.

Importance of the Capital Market in Economic Development :

The capital markets are a place where people come to grow their money or business well and create wealth in the long run. A strong and efficient capital market contributes to a country’s development in several ways:

• A well-established and growing capital market always promotes entrepreneurship by providing access to long-term capital.

• This market strengthens infrastructure, manufacturing, and many other sectors by funding large-scale public and private projects.

• Regulatory oversight and public accountability improve corporate governance. • A growing capital market increases the confidence of investors and encourages them to invest more capital in the economy.

Some Important Instruments Of The Capital Market

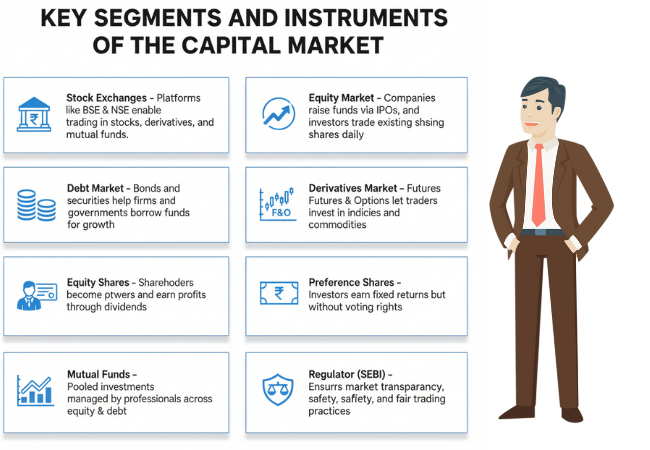

Capital markets are crucial for helping businesses and governments raise long-term funds from investors. Here are the different segments and financial instruments to understand different investment needs and their risk appetite.

1. Stock Exchange –

There are two main stock exchanges in our country –

• Bombay Stock Exchange (BSE) – It is one of the oldest stock exchanges in Asia. It allows us to trade in stocks, derivatives and mutual funds.

• National Stock Exchange (NSE) – It is the largest stock exchange in India by market cap, NIFTY50 index is a famous index of NSE.

2. Equity Market

• Primary Market: This is where companies issue new shares for the first time. Companies raise funds through Initial Public Offering (IPO) and Follow-on Public Offering (FPO).

• Secondary Market: This is where both old and newly issued shares are traded. For example, shares of HDFC Bank and Infosys are bought and sold on BSE and NSE.

3. Debt Market

• Corporate Bonds: Companies issue bonds to raise capital. Investors who purchase bonds become creditors of the company. Example: TATA Motors and ADANI GREEN ENERGY LTD.

• Government Securities (G-Secs): The government issues these to meet its budget deficit. Examples include treasury bills and long-term bonds.

4. Derivatives Market

• Futures and Options: Contracts based on assets such as stocks or indices. NSE offers these contracts for indices like NIFTY 50.

• Commodity derivatives: Traded on exchanges like MCX and NCDEX, these include futures contracts for gold, silver and agricultural products.

5. Equity Shares:-

Those who buy equity shares of a listed company become owners of that company, with significant voting rights, and the potential for capital appreciation and dividends.

6. Preference Shares: These shareholders receive fixed dividends and returns, but they do not have voting rights.

7. Mutual Funds: Investment funds collect money from investors and invest it in a diversified portfolio managed by professional fund managers. These funds can invest in equity, debt and hybrid instruments.

8. Regulator: SEBI regulates the capital market through its rules, regulations and guidelines. SEBI operates the capital market and protects investor returns from fraud and scams.

They took serious steps to stop the fraudulent activity.

Final Conclusion

Capital markets are vital to the financial industry. They connect investors with businesses and governments. This means they bring together those who provide capital (investors) and those who want it for their own purposes (governments and businesses).

Capital markets are the backbone of the economy. They help both businesses and investors grow, and the economy also begins to grow.

Understanding the structure, basics, and importance of the capital market is essential for anyone who wants to participate in it. Whether you are an investor or a finance professional, staying informed about market trends will help you make better financial decisions.

3 thoughts on “Introduction to the Capital Market: Meaning, Structure, Functions, and Works.”