The company Lenskart is launching its IPO on October 31, 2025, and it will close on November 4, 2025. – The Lenskart IPO is a combination of a fresh issue of 5.35 crore shares (total ₹2150.00 Crore) and an offer-for-sale of 12.76 crore shares (total ₹ 5128.02crore) with a price band of ₹382 to ₹402 per share. The company aims to raise ₹7278.02 crore from investors through the financial markets. According to the upper band price, the estimated market valuation of the issue is approximately ₹70,000 crore.

Lenskart Solutions Limited is a technology-driven eyewear company that designs, manufactures, brands, and retails eyewear products.

Lenskart was founded in 2008 by Peyush Bansal, along with co-founders Amit Chaudhary and Sumeet Kapahi. Lenskart started as an online optical store under its parent company, Valyoo Technologies Private Limited, but has now evolved into a fully omnichannel eyewear brand, combining online convenience with an offline retail experience.

The company designs both its spectacle frames and lenses. The company claims to be the largest seller of prescription eyewear in India by volume. Lenskart operates over 2,000 retail outlets across India, and the company also has a presence in international markets such as Southeast Asia, the Middle East, the USA, and Japan.

Lenskart IPO: Important Dates and Timelines

The price band of the Lenskart IPO has been fixed at ₹382 to ₹402 per share. The lot size for applications is 37 shares per lot. Therefore, the minimum investment amount required for a retail investor is ₹14,874 (37 shares) (based on the upper price band). The lot size investment for SNII is 14 lots (518 shares), costing ₹2,08,236, and for BNII it is 68 lots (2516 shares), costing ₹10,11,432.

Let’s look at some important details related to the Lenskart IPO :

| Parameters | Details |

| IPO Open Date | 31 October 2025 |

| IPO Close Date | 04 November 2025 |

| Issue Price range | ₹ 382 to ₹ 402 per equity share |

| Face Value | ₹ 2 per share |

| Lot Size | 37 shares per lot |

| Total Issue Size | ₹ 7278.02 Crore (Both OFS and Fresh Issue) |

| Offer For Sale | ₹ 2150.00 Cr ( 5.35 crore Shares) |

| Total Fresh Issue | ₹ 5128.02 Cr (12.76 Crore Shares) |

| Registrar | MUFG Intime India Pvt Ltd. |

| Employee Discount | ₹ 20.00 |

| Listing At | NSE Or BSE |

Lenskart IPO Important Timelines:

The Lenskart IPO is open for subscription from October 31st, 2025, and will close on November 04, 2025. The allotment for the Lenskart IPO is expected to be finalized on November 06, 2025. The IPO is going to be listed on both the BSE and NSE exchanges, with a tentative listing date of November 10, 2025.

| IPO Open Date | Fri, 31 October 2025 |

| IPO Close Date | Tue, 04 November 2025 |

| Allotment Date | Thu, 06 November 2025 |

| Initiation of Refund | Fri, 07 November 2025 |

| Shares Credit to Demat | Fri, 07 November 2025 |

| Listing Date in Exchange | Mon, 10 November 2025 |

Lenskart IPO Lot Sizes:

The company Lenskart is raising ₹7278.02 crore from investors through financial markets. Retail investors can bid for a minimum of 37 shares (1 lot) in this IPO. Like every IPO, the Lenskart IPO also has minimum and maximum investment limits for individual investors (retail) and high net worth investors (HNIs) in terms of shares and amount. Let us take a look at the prescribed amounts for different investor slabs.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 37 | ₹ 14,874 |

| Retail (Max) | 13 | 481 | ₹ 1,93,362 |

| S-HNI (Min) | 14 | 518 | ₹ 2,08,236 |

| S-HNI (Max) | 67 | 2,479 | ₹ 9,96,558 |

| B-HNI (Min) | 68 | 2,516 | ₹ 10,11,432 |

Investor category and their reservation:

| Investor Category | Reservation |

| Qualified Institutional Buyers (QIBs): | 75% ( 13.58 Crore shares ) |

| Non-Institutional Investors (NIIs/HNIs): | 15% (2.74 Crore shares ) |

| Retail Individual Investors (RIIs): | 10% (1.81 Crore shares ) |

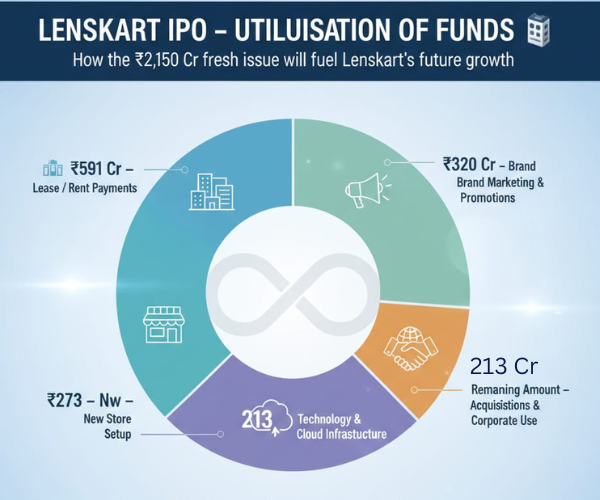

Utilisation of Proceeds

| Purpose | Values in Cr |

| Allocated for capital expenditure to set up new (CoCo) stores in India | 272.62 (12.68%) |

| Payments related to lease/rent/licence agreements for the CoCo stores in India. | 591.44 (27.51%) |

| Investment in technology and cloud infrastructure, including backend platforms | 213.38 (9.93%) |

| Brand marketing and business promotion expenses | 320.06 (14.89%) |

What is Lenskart? (Company Overview)

Lenskart is a business that sells eyeglasses and lenses. It was founded in 2008 by Piyush Bansal. The company started as an online optical store under its parent company, Valyoo Technologies Private Limited, but has now become a full-fledged omnichannel eyewear brand, combining the convenience of online shopping with an offline retail experience.

If you want to learn about Stock Market Investment, Learn from here

Some Key Features of the Lenskart

Founded in 2008, Lenskart Solutions Limited is a technology-focused eyewear company that designs, manufactures, brands, and retails prescription glasses, sunglasses, contact lenses, and accessories.

The company’s business model is a direct-to-consumer model. The company sells a wide range of eyewear under its own brands and sub-brands such as Lenskart, John Jacobs, Aqualens, and Hooper, targeting different customer segments – from budget-conscious buyers to premium customers.

As of March 31, 2025, Lenskart has 2,723 stores worldwide, including 2,067 in India and 656 internationally – 1,757 company-owned and 310 franchised stores in India. Remote eye testing facilities are available at 168 stores in India and select international locations, including Japan and Thailand, managed by 136 optometrists.

Lenskart IPO Financial Overview:

Here is the company’s financial information for the last three years:

ALL values in crores –

| Periods Ended | FY25 | FY24 | FY23 |

| Total Revenue | 6652.52 | 5,427.7 | 3,788.03 |

| Profit After Tax | 297.34 | -10.15 | -63.7 |

| Net Worth | 6,108 | 5,642 | 5,444 |

| Total Assets | 10,471 | 9,531 | 9,528 |

| Reserve and Surplus | 5855 | 5,467 | 5,412 |

| EBITDA Margin | 14.60% | 12.38% | 6.86% |

| PAT Margin | 4.47% | -0.19% | -1.68% |

| Debt / Borrowings | 345.94 | 497.16 | 1,430.9 |

| Return on Equity (RoE) | 4.88% | -0.18% | -1.16% |

Lenskart Solutions Limited recorded revenue of ₹3,788 crore in FY23, which increased to ₹5,427.7 crore in FY24, representing a growth of 43%. In FY25, revenue increased to ₹6,652.5 crore, representing a 21% growth over FY24. Lenskart’s operating revenue has grown by 76% in two financial years.

Lenskart reported a net loss of ₹63.7 crore in FY23, which reduced to ₹10.15 crore in FY24 – a remarkable 84% recovery. In FY24 and FY25, the company reported a Profit After Tax (PAT) of ₹297.3 crore, a significant increase compared to FY24.

Strengths of Lenskart:

- Lenskart Solution Limited is India’s largest seller of prescription eyeglasses in terms of volume in FY25.

- In FY25, the company launched 42 and 105 new in-house designed collections worldwide, including collaborations with popular brands and celebrities.

- In FY25, Lenskart was awarded “India’s Most Trusted Eyewear Brand in 2025” by TRA Research. stores in India and the remaining 669 stores internationally

The company has a robust omnichannel network as of June 30, 2025. The Lenskart mobile app has been downloaded over 100 million times. It operates its business through 2806 stores worldwide, with 2137

Risks Involved in Lenskart IPO

A significant portion of Lenskart’s expenses consisted of raw material costs. Any disruption, delay, or shortage in the supply of raw materials and fluctuations in raw material prices could impact Lenskart’s entire business, its operations, and its finances. This represents a major risk in this business.

Lenskart incurred losses in FY23 or FY24 primarily due to operating leverage. The company also reported negative cash flow from financing and investing activities this year. Its profitability depends on scaling.

Greater dependence on India for revenue; International contributions have been limited so far.

The company is facing tough competition from online and offline eyewear players like Titan. The company imports most of its frames and other raw materials from China, with approximately 40-50% of its raw materials sourced from there. Delays and disruptions in the supply of raw materials could impact the business and its operations

The Conclusion

Lenskart’s journey from a small online eyewear startup to one of India’s most valuable D2C (direct-to-consumer) unicorn companies reflects innovation, technology-driven operations, and a customer-centric strategy. Lenskart IPO offers an attractive investment opportunity in the global eyewear industry. Its expansion into Southeast Asia and the Middle East, along with strategic acquisitions and offline presence, positions it for long-term growth. The company has achieved consistent revenue growth over time and is improving its profitability.

You can invest in the Lenskart IPO, but do so at your own risk, only after thoroughly researching the company, analyzing its financial reports, and understanding its business model. Short-term investors may see some gains from the listing, while long-term investors could benefit from the company’s continued growth in the financial services sector.

Frequently Asked Question

What is the price band of the Lenskart IPO?

The Lenakart IPO price band is ₹ 382 to ₹ 402 per share.

What is the lot size and minimum investment?

Each lot contains 37 shares, making the minimum investment ₹14,874 at the upper price band.

When does the Lenskart IPO open and close?

The Lenskart IPO Opens For subscription period from October 31, 2025, and it will close on November 04, 2025.

What is the total issue size of the Lenskart IPO?

The total IPO size is ₹ 7278 crore, including ₹ 2150 crore as a fresh issue and ₹5128 crore via Offer for Sale (OFS) by promoters.

When will Lenskart Company shares be allotted to investors?

The Share of Lenskart Company allotted to investors on Tue 06, November 2025.

On which stock exchanges will the Lenskart IPO be listed?

The Lenskart IPO is going to list on both the NSE AND BSE exchanges.