In this dynamic world, people engage in a variety of activities to earn money. But among all these methods, Investing has proven to be the most powerful way to build wealth. Every types of investors participates in financial markets based on their personal goals after understanding their risk appetite well.

Today, we’ll explore the different types of investors in detail, including their characteristics, investment strategies, risk tolerance, and their differences from other investors.

What is an investor?

An investor is an individual or institution (financial firm) that allocates capital (money) across various types of assets to earn profitable returns. They invest with clear financial goals, such as funding children’s education, purchasing a home, building a retirement fund, and accumulating wealth over time.

Investors are called the backbone of any economy because they bridge the gap between those who have money and those who need it, such as businesses or governments, which raise funds from investors to expand operations, build infrastructure, and strengthen the economy.

With the development of financial markets, investors today have access to a wide range of asset classes, such as equities, debt, mutual funds, commodities, futures and options, gold and silver, retirement plans, real estate, and precious metals. Investors select and research various types of investments to achieve maximum returns with minimum risk.

Passive Investor v/s Active Investor

In the world of investing, all types of investors are generally divided into two main categories: active and passive. These two types determine how individuals and institutions approach wealth creation.

A passive investor prefers simplicity and consistency. Due to their conservative investment approach and style, they primarily invest in index funds (such as the S&P 500 or Nifty 50) or exchange-traded funds (ETFs). Owning an index fund or ETF means they own a basket of stocks (many stocks from different sectors), allowing them to benefit from a rising market without analysing any specific stock.

Passive investors do not attempt to predict market movements or outperform the Stock market. They remain invested even during market downturns because they focus on long-term compounding rather than short-term price fluctuations.

Active investors invest their money in a specific stock based on fundamental analysis of the company, after understanding its cash flow, financial ratios, market trends, and sector growth opportunities. Their goal is to beat the market by identifying undervalued stocks and purchasing them at low prices. They are called “value investors.” They only purchase high-priced and high-quality stocks at their intrinsic value. Their goal is to outperform the benchmark index.

Both styles have their advantages, but passive investing is considered safer and more stable for beginners, while active investing requires in-depth knowledge, patience, and discipline

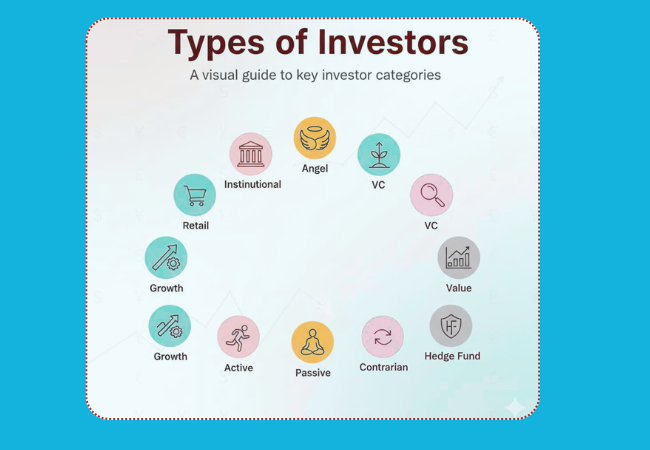

Types of Investors

There are many types of investors participating in the financial market. Let’s learn in detail –

1.Retail Investors :

These are individual investors who invest their money in the financial markets every day through brokerage firms and apps. They typically rely on their own research or recommendations from analysts, financial advisors, or online sources to invest in stocks, bonds, mutual funds, and ETFs. These retail investors are not professional investors.

They work with small amounts of money to achieve higher returns than traditional investments like fixed deposits and savings accounts. Their investment amounts are relatively small compared to larger institutions, but collectively, they contribute significantly to market liquidity.

2.Angel Investors (Startup Investors) :

Angel investors are high-net-worth individual investors who provide their personal capital to startups, growing businesses, and entrepreneurs. Angel investors invest capital in businesses in exchange for a stake in equity shares. Angel investors not only bring capital to businesses, but they also act as mentors to business owners, sharing their experience, industry knowledge, contacts, and guidance with founders.

Among all types of investors, angel investors take a high risk because they invest in the early stages of a business when the risk is very high. Investing in early-stage businesses is uncertain: many startups fail due to competition, product-market fit, and a variety of other reasons. Investors then lose all their money. However, when startups and businesses succeed, investors earn returns of 10x, 20x, or even 50x on their investment.

3.Venture Capitalist :

Venture capitalists constitute another significant group within the types of investor category. Venture capitalists are professional investment firms that pool funds from wealthy individual investors or manage their funds to invest in new startups or businesses. Venture capitalists invest in small startups and businesses that are not very small but have already passed the angel funding stage and need more capital to grow and expand their businesses.

Their approach differs from that of angel investors; angel investors invest based on the founder’s potential. Venture capitalists, on the other hand, take calculated risks based on business metrics, scalability, management capabilities, and long-term potential.

4.Institutional Investors :

Institutional investors are large financial organisations such as mutual fund houses, pension funds, insurance companies, hedge funds and sovereign wealth funds that manage others’ money and invest it in various asset classes.

These institutional firms raise large sums of money from the public, so they have a large AUM (assets under management), allowing them to purchase large quantities of assets. Their large AUM makes them the most powerful among the advanced types of investors. They can manipulate the price fluctuations of any asset class through large investments.

Institutional investors employ teams of analysts, economists, and quantitative modellers to make data-driven decisions. Domestic institutional investors act as market stabilisers during periods of high market volatility, maintaining investments and supporting the market when retail participants panic-sell.

5.Peer To Peer (P2P) Lending :

Peer-to-peer lending investors are those investors who lend money directly to individuals, small businesses and entrepreneurs through digital platforms, cutting out the traditional middlemen such as Banks or NBFCs. For Example, Faircent, LenDen Club, here, individuals and businesses seek to raise funds from many investors in exchange for the rate of return on their capital. Investors can lend their capital to many different borrowers; these steps can minimise their risk of losing capital.

6.Value Investors :

Value investors are a specialised group within the broader types of investor landscape. Value investors are investors who believe in buying “high-quality businesses at the lowest price.” Value investors engage in qualitative and quantitative research about companies (stocks).

Before investing in any company, they analyse financial ratios, profit and loss statements, cash flow statements, management track records, and read the company’s balance sheet and annual reports. Once they find quality stocks, they invest in them and hold them for years or decades, accumulating wealth over time.

Where do Investors Invest their Money?

All types of Investors invest their capital in assets with the hope that the value of the assets will increase over time, earning them a return on their invested capital. For this reason, investors invest in any asset that can generate a profit. Let’s take a look at the list of assets investors invest in:

• Equity shares – An investor invests in shares of a publicly listed company. By owning the shares, they become the owner of the company. When the company (stock) grows, investors earn a profit on their investment.

• Bonds – Bond investing involves an investor purchasing fixed-income securities from corporations and governments, which receive a fixed rate of return over a specified period. Upon maturity, the company pays back the principal amount plus interest to the investor. Bonds are debt certificates.

• Mutual funds – An investor can purchase a portfolio of stocks and bonds managed by professional managers. The investment objective here is to diversify the portfolio by including a variety of stocks from different sectors. Here, mutual fund houses charge a percentage of our investment value for managing our capital.

• Exchange-Traded Funds (ETFs) – Investors invest in a basket of stocks, bonds, and other assets. You can purchase small-sized indexes as ETFs. ETFs are similar to mutual funds. The advantage of investing in ETFs is that ETFs trade on stock exchanges like shares. Therefore, you can redeem your investment on any market day.

• Real Estate – Investors can physically purchase a piece of land, or they can buy through a Real Estate Investment Trust (REIT) without owning the physical property. These provide rental income (cash flow) and an increase in value over time.

• Commodities – Investors purchase commodities like gold, silver, crude oil, and agricultural products to diversify their portfolios. Precious metals like gold and silver are considered safe-haven investments during times of economic uncertainty. These assets have a value due to their use in the world. Their value increases over time.

• Private Equity and Start-ups – Angel investors typically invest in private equity and new-age start-ups. These are considered very risky investment options, but they also offer potentially high returns.

• Digital Assets – Investors are investing in cryptocurrencies, such as Bitcoin, ETH, Solana, and Doge. These digital currencies are programmed on the blockchain. These are very risky assets with high growth potential.

• Alternative Commodities – Investors can invest their money in alternative assets, such as venture capital, hedge funds, art, precious metals, infrastructure investment trusts (InvITs), and collectables.

Investors invest their capital in these assets and earn money in two ways: appreciation and income. When an investor buys an asset with the expectation that its value will increase over time and that they will sell it to earn a profit, this is called appreciation.

Income is the regular payment of money received from assets owned. For example, real estate (buildings and hotels) or bonds are assets that pay regular income to their investors.

Final Conclusion :

In short, an investor is any individual or financial institution that allocates its capital in assets to generate returns over time. Investors come from all walks of life, whether they’re small investors investing from home or investors managing billions of dollars. Ultimately, the objective of all investors is the same: to accumulate wealth by earning returns on their investments.

All investors invest in various financial instruments, such as stocks, bonds, mutual funds, exchange-traded funds, gold, crypto, and other assets. They invest in all assets to diversify their portfolios.

Frequently Asked Question

What are the different types of investors?

There are different types of investors, including retail investors, angel investors, venture capitalists, institutional investors, value investors and P2P lending investors.

Who is called an investor?

An investor is a person or financial entity that puts or allocates money into assets expecting future returns on their investments.

What is the main role of an investor?

An investor allocates capital to businesses, markets or assets to earn profits and support economic growth. They are called the backbone of the economy.

What is the difference between active and passive investors?

Active investors research and select specific stocks, while passive investors invest in index funds or ETFs without frequent buying or selling.

Who are angel investors?

Angel investors fund early-stage start-ups in return for equity. They take high risks but can earn massive returns if the business succeeds.

Who are venture capitalists?

Venture capitalists invest in start-ups that already have product traction and need larger capital. They provide funds in exchange for equity and help scale the business.

What are institutional investors?

Institutional investors are organisations, such as mutual funds, insurance companies, and pension funds. They manage substantial capital and have a significant influence onmajor market movements.

What is value investing?

Value investing focuses on buying undervalued but fundamentally strong companies. These investors hold stocks long-term to benefit from price appreciation.

Where do investors invest their money?

Investors put money primarily into equity, bonds, mutual funds, ETFs, real estate, commodities, crypto and start-ups. Their choice depends on risk tolerance and goals.

Which type of investor is safe for beginners?

Passive investors are safest for beginners because they invest in diversified index funds. It reduces risk and provides a stable long-term return.

8 thoughts on “What are the different types of Investors? : Their Roles And Functions”